Protecting Your Investments with Enhanced Security

In light of recent cybersecurity incidents affecting capital markets — as highlighted in the joint statement by the Securities Commission Malaysia (SC) and Bursa Malaysia — Phillip Mutual Berhad is taking proactive steps to strengthen the protection of our clients’ accounts and investments.

While our systems have not been affected, we believe in prevention over cure when it comes to safeguarding your personal information and financial assets.

Why MFA is Important and How Does It Protect You

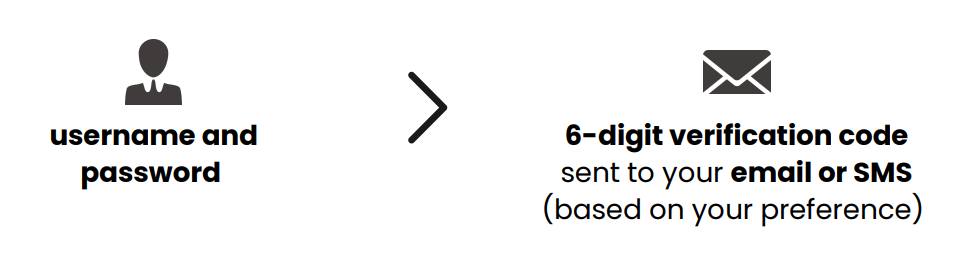

Multi-Factor Authentication (MFA) adds an extra layer of security to your login process. It ensures that even if your password is compromised, your account remains protected.

Login to our platforms will require :

What You Need to Do

STEP 1 :

Ensure your email and mobile number are up-to-date with us.

↓

STEP 2 :

Choose your preferred method (email or SMS) to receive your verification code.

↓

STEP 3 :

Enter the 6-digit code to complete your login.

🔎 Suspect Suspicious Activity?

If you notice any unauthorised activity or believe your account has been compromised, please contact us immediately :

📱 Hotline : (603) 2783 0300.

📧 Email : eunittrust@phillipcapital.com.my

💬 Live Chat : Available at the bottom right of our website

Thank You for Your Trust!

We appreciate your continued trust in Phillip Mutual. This enhancement reflects our ongoing commitment to protecting your investments and keeping your personal information secure — without making your experience more complicated.