Celebrate Together with GongXiRaya

Kongsi Rezeki, Kongsi Huat

Bringing together the spirit of Chinese New Year & Hari Raya Aidilfitri, for a celebration of prosperity, togetherness, and shared blessings.

Propel your portfolio forward with our festive special: Invest @ 0% Sales Charge* while standing a chance to win a’MA’zing Prizes. Horsey Liao!

Why Join This Promo?

✔️Enjoy 0%* Sales Charge

✔️388 Unit Trust Funds Offered

✔️Double entries for Phillip Funds

✔️Chance to win a’MA’zing Prizes

Don't just celebrate the season—capitalize on it.

Start investing to secure these festive perks & potential long-term financial

growth.

a'Ma'zing Prizes Worth RM 6,888 Awaits!!!

| Reward Level | Prize Item | Quantity |

|---|---|---|

| 🥇 Grand Prize | 2.5-gram Physical Gold Bar (*Worth Approx: RM3,500) | 1 Winner |

| 🥈 1st Runner Up | 1.0-gram Physical Gold Bar (*Worth Approx: RM700) | 1 Winner |

| 🥉 2nd Runner Up | 0.5-gram Physical Gold Bar (*Worth Approx: RM350) | 1 Winner |

| 🎖️ Consolation | 0.2-gram Physical Gold Bar (Worth Approx: RM250) | 5 Winners |

| 📱 Consolation | T&G eWallet Reload Pin (*Worth: RM58) | 18 Winners |

*Phillip Mutual Berhad reserves the right to substitute physical gold prizes with a grammage equivalent to the prizes' fixed cash (RM) value listed in the campaign, regardless of gold price fluctuations.

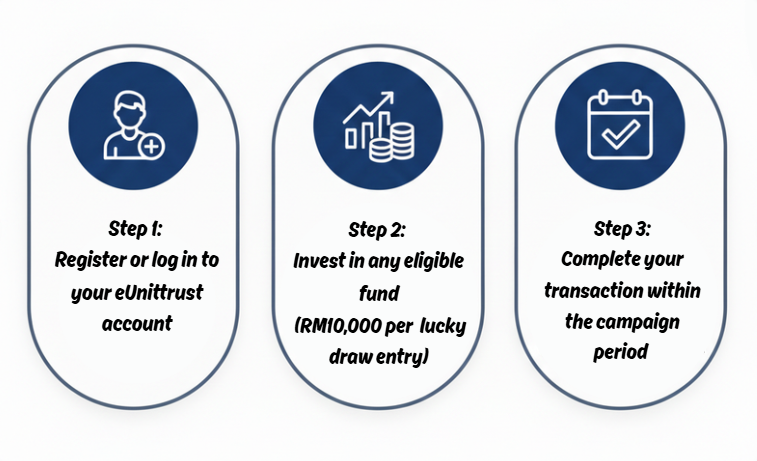

How to Participate

Celebrate GongXiRaya with a'Ma'zing Prizes! ✨

RECOMMENDED FUND LIST!

- This promotion is only valid from 3 February – 28 April 2026 (cut-off time 3:00 PM).

- Investors must invest a minimum of RM10,000 into any of the 388 selected funds on the eUnittrust platform during the campaign period to qualify for one (1) lucky draw entry.

- An investment of RM10,000 in Phillip in-house funds will be entitled to two (2) lucky draw entries.

- Each investor is capped at a maximum of one hundred (100) lucky draw entries during the campaign and is entitled to win only one (1) prize from the list of lucky draw prizes.

- Investments in Money Market Funds (MMFs) are excluded from the campaign.

- Campaign participants must keep their investment active without any full withdrawal until the end of the campaign period to qualify for the lucky draw.

- This promotion is only applicable to eUnittrust.com.my account holders. Participants without an account must open one to be eligible.

- This promotion is only valid for online transactions made via the website www.eunittrust.com.my.

- All newly onboarded funds under the eUnittrust platform during the campaign period will participate in the campaign.

- eUnittrust.com.my account holders who purchase selected promotional funds are not eligible for any other referral program incentives or contests.

- This promotion does not apply to Transfer, Switching Transactions, Regular Savings Plan (RSP), or Cooling Off transactions.

- Phillip Mutual reserves the right to modify the terms and conditions or to cancel, terminate, or suspend the campaign without prior notice.